If you accept checks, be sure to also include the check number with the sales receipt. To make sure your books are as accurate as possible, make sure you organize business receipts using a storage system (e.g., filing cabinets or computer). Sales receipts typically include things like the customer’s name, date of sale, itemization of the products or services sold, price for each item, total sale amount, and sales tax (if applicable).

How To Account for Cash Receipts

This will ensure that your cash flow and ultimately your profit are correct. The accountant would then use the reference number obtained from the journal to search through source materials and identify the specific receipt in question. If you plan on depositing cash payments, make sure your deposit slip amount matches your cash receipts journal. Store deposit receipts along with your other business receipts in case of any discrepancies.

Step 2. Accounts credited

The amount of $506 is then placed in both the cash debit column and the sales credit column. A person who serves as an escrow agent is a fiduciary, with duties to allparties who have an interest in the escrow property. If it’s money, it must be deposited ina special bank account that’s separate from the escrow agent’s personal andbusiness accounts. Keeping track of what are the risks of an accounting career your business’s cash receipts in a timely manner is necessary for efficient financial management. Journal and Ledger are the two pillars which create the base for preparing final accounts. The Journal is a book where all the transactions are recorded immediately when they take place which is then classified and transferred into concerned account known as Ledger.

Cash sale

The practical suggestions in this pamphlet are based upon New York laws,rules and court decisions. Observing them will help consumers avoiddisagreements in escrow transactions, and prevent the misuse or loss ofescrow money and property. The Supreme Court has authority to appoint a successor signatory for the attorney trust account. In terms of details, the journal entry would include additional information such as a date column, amount total, account number (if applicable), and so on. They also keep track of outstanding supplier payments by matching cash received with cash paid.

- All of our content is based on objective analysis, and the opinions are our own.

- A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- If you use bookkeeping or accounting software, you can conveniently store one copy with the sale.

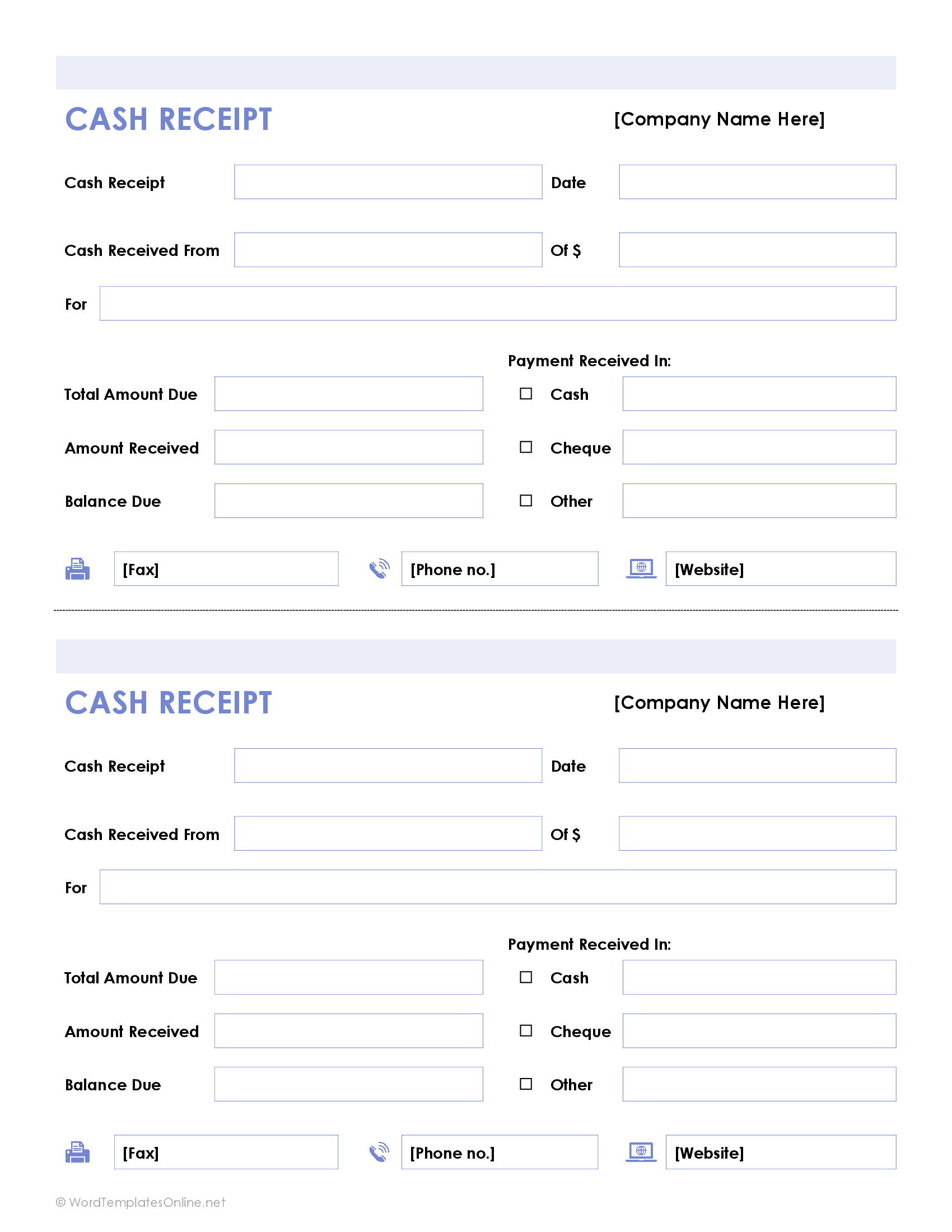

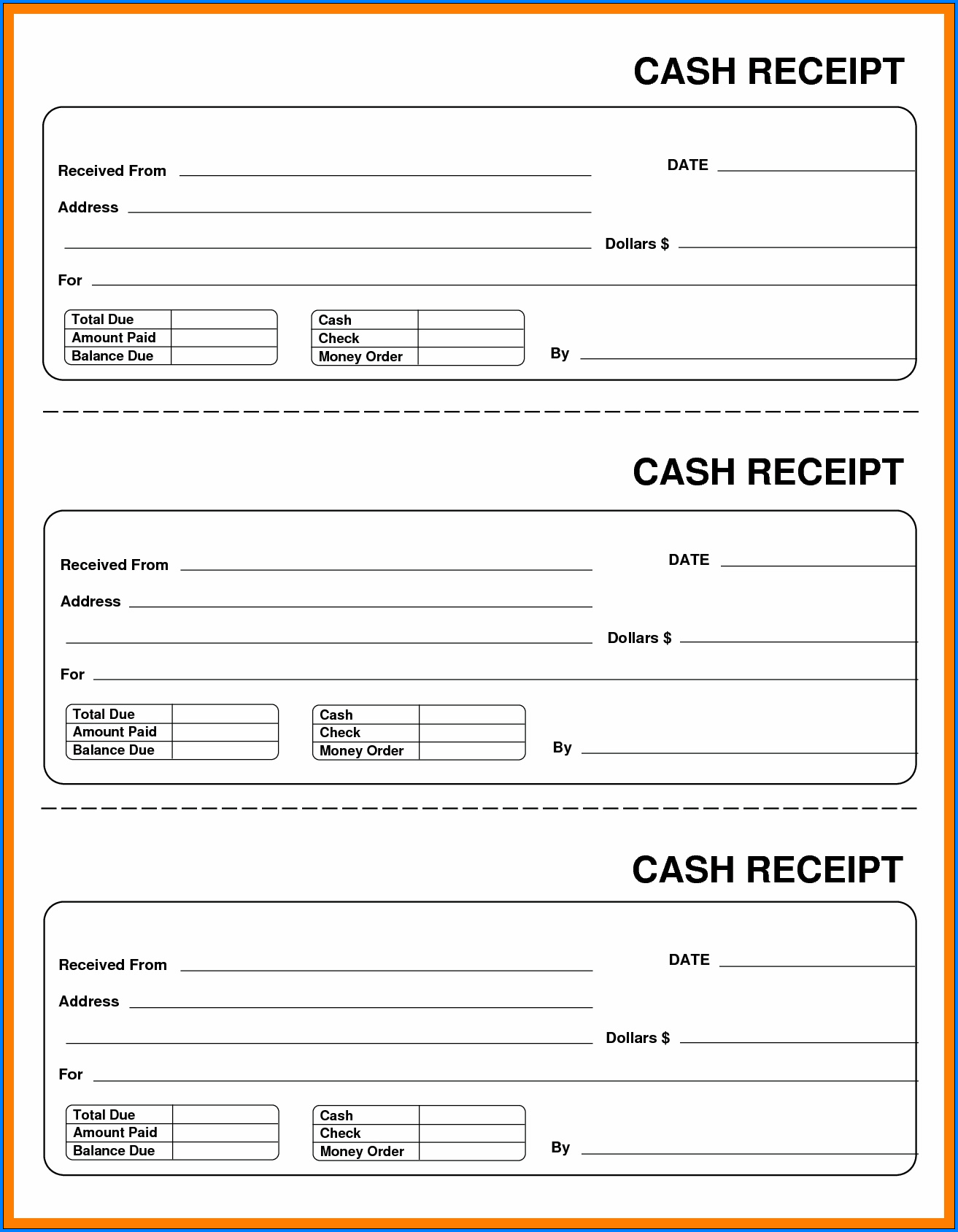

- Depending on a company’s requirements, different formats are used for a cash receipts journal.

What Information is Included in a Cash Receipts Journal?

Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor). Special journals (in the field of accounting) are specialized lists of financial transaction records which accountants call journal entries. In contrast to a general journal, each special journal records transactions of a specific type, such as sales or purchases.

Journal and Discounts Allowed

All additional cash sources, including bank interest, investment maturities, sales of non-inventory assets, sales of fixed assets, etc. An escrow agent has the legal duty to comply strictly with the terms andconditions of the escrow agreement. Escrow property cannot be delivered toanyone, except in accordance with the provisions in the escrow agreement.

Your books must show your gross income, as well as your deductions and credits. The physical or electronic owner’s copy of the cash receipt is called a source document in the accounting for cash receipts. Source documents are the proof that a sale was actually made and payment received. It should be kept for income tax reporting purposes and to support your financial statements.

And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet. The total from each column in a cash receipts journal is posted to the appropriate general ledger account. In addition, the post reference “cr” is recorded to indicate that these entries came from the cash receipts journal.

This way an accountant or bookkeeper can analyze the amount of cash collected and recorded during a period separate from all other journal entries in the general journal. In our example, the only other credit column featured in the cash receipts journal is for all other accounts. It is set up in the same way that the other column on the debit side is, except that the account title area is replaced by a “Ref.” column. As the example shows, a typical cash receipts journal consists of many columns. This is necessary because there are numerous transactions that lead to the receipt of cash. If an escrow agentexpects to be paid for administering an escrow account or property, thematter of fees and reimbursement of expenses should be clearly set forth inthe escrow agreement.

Whenever a company receives cash for any reason, the journal entry is recorded in the cash receipts journal. An escrow agent should provide the parties with a receipt for the escrowproperty, a copy of the escrow agreement and keep complete and accuraterecords. Depositors and beneficiaries have a right to a full accounting ofthe escrow agent’s management of the escrow property. A journal is where financial transactions are first recorded and are recorded chronologically with a brief explanation. The ledger sorts and groups accounts from the journal’s business transactions showing the summaries and totals of each individual income and expense account in the receipt ledger.